If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

California solar panel tax credit 2019.

Filing requirements for solar credits.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

22 tax credit extended for solar pv systems installed between 1 1 2021 12 31 2021 10 tax credit extended for solar pv systems installed between 1 1 2022 12 31 2022 after january 1 2023 the federal solar tax credit will no longer be an available advantage for homeowners in california.

The federal solar tax credit is 26 of the cost of a system in 2021.

1 the golden state is setting the gold standard for clean energy policy 2 with an ambitious goal to run on 100 carbon free energy by 2045.

Check out our top list of incentives to go solar in california.

Homeowners have access to rebate programs in many areas of the golden state.

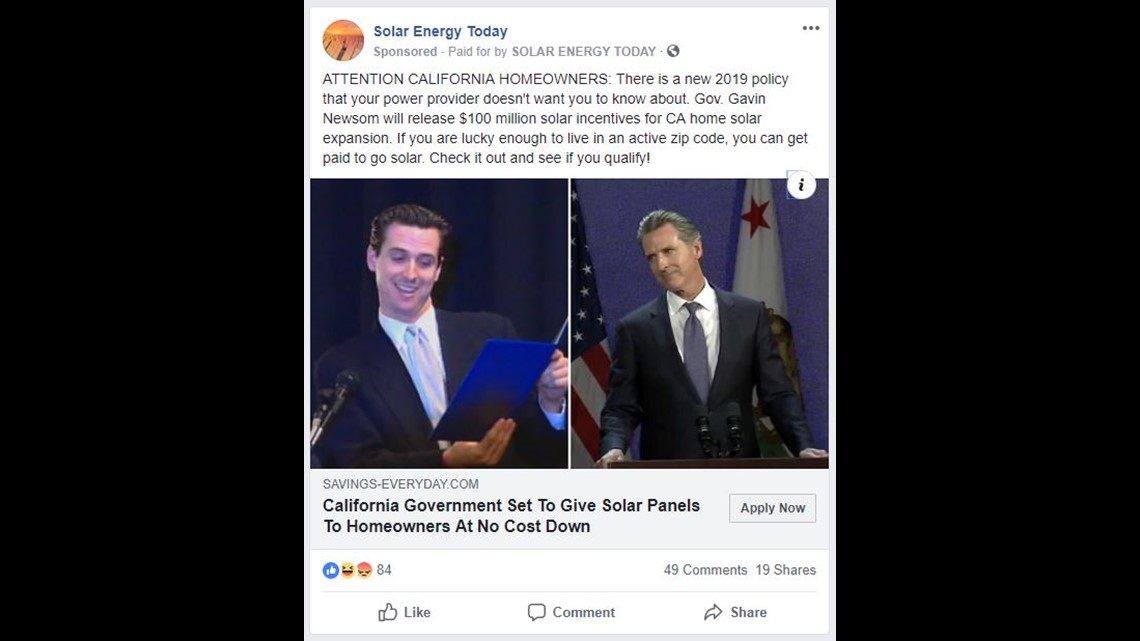

When people refer to the california solar tax credit they are mistakingly referring to the federal solar tax credit which applies to all american homes including those in california.

What are the main california solar tax credits and rebates.

These rebates can pay solar shoppers anywhere from 500 total to 0 95 per watt of installed capacity.

Don t hesitate and miss out.

Ensure you receive the full 26 solar tax credit and additional incentives for going solar in 2020.

How much is the california solar tax credit in 2020.

Here are just two.

To claim the credit you must file irs form 5695 as part of your tax return.

The residential energy credits are.

With one of the sunniest climates in the world it s no surprise that california is the no.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

You calculate the credit on the form and then enter the result on your 1040.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

1 solar state in the country.

There is no california solar tax credit.